Finding the perfect partner: where profit meets purpose

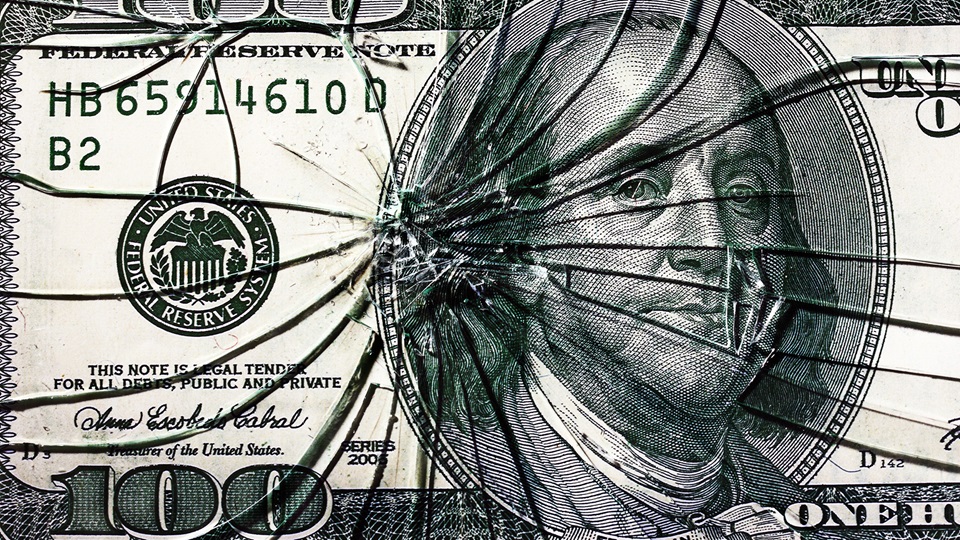

Finance often gets a bad rap – sometimes justified! – yet it’s a sector that looms large because of the extraordinary leverage it can bring to bear. As our sustainable investment analyst Neil Smith explains, when harnessed right, it can help create a whole lot of good.

In the world of investments, everyone loves a good story. And surely, there’s none better than a company that not only makes money, but also does right by society and the planet.

Recently, people have come to believe that companies must choose between profit and principles. That one must inevitably come at the expense of the other. We think that’s a fallacy. And there’s a long history for our way of thinking.

The tools we use can be traced back to the early 1980s, when social philosopher come entrepreneur Freer Spreckley advocated for businesses to measure and report on financial outcomes, social value creation and environmental responsibility. This concept was further developed a decade later by fellow Brit John Elkington, who introduced the ‘Triple Bottom Line’ framework – emphasising the importance of “people, planet and profit”.

Some sectors, like healthcare or clean energy, naturally fit this model. Their products and services often have a direct, positive impact on people’s lives or the environment. But what about a less obvious sector, such as financial services? It’s a trickier story to tell. Their influence is more indirect and is channelled through the projects they choose to finance. That’s why, when a financial firm does manage to strike the right balance between profit and purpose, it’s worth paying attention.

An active approach to hitting net zero

One such company is Partners Group, a Swiss private equity manager (which we hold in our Rathbone Greenbank Global Sustainability Fund and the Rathbone Greenbank Multi-Asset Portfolios). Since 1996, the firm has deployed over $234 billion across private equity, infrastructure, real estate, private credit, and royalties on behalf of clients worldwide. What distinguishes Partners Group is not just the scale of its investments, but the strategic approach it takes in deploying capital.

As outlined in its 2024 Sustainability Report, Partners is committed to “delivering long-term value to its investors, communities, and the planet.” The firm doesn’t sacrifice returns for impact. Instead, it integrates sustainability through double materiality assessments, which evaluate both the financial risks posed by environmental and social factors, and the potential positive impact investments can have on society and the planet. As an active manager ourselves, we like the fact that Partners is selective in what it invests in, as opposed to just passively hugging a benchmark or index. This approach has enabled the firm to achieve strong financial outcomes while pursuing ambitious environmental goals, including its commitment to become a net zero company by 2050 and ensuring that its portfolio companies also hit that milestone.

Partners Group's plan to create a net-zero portfolio

| Portfolio net zero targets* | By 2030 | By 2050 |

|---|---|---|

| Private Equity Directs | 53% of invested capital expected to be managed in alignment with net zero | 100% of invested capital expected to be managed in alignment with net zero |

| Private Infrastructure Directs | ||

| Private Equity Partnerships | 14% of committed capital expected to be managed in alignment with net zero | 100% of committed capital expected to be managed in alignment with net zero |

| Private Infrastructure Partnerships | ||

| Private Credit Directs | To be developed in 2025 | 100% of invested capital expected to be managed in alignment with net zero |

Source: Partners Group; 2024, *Other asset classes will be added as third-party guidance becomes available

In 2018, Partners Group took this a step further by launching its LIFE investment strategy (short for Lead, Impact, Focus, Engage). This strategy focuses on investments that contribute meaningfully to at least one of the 17 United Nations Sustainable Development Goals (UN SDGs) – a global framework established in 2015 to address critical challenges such as poverty, inequality and environmental degradation through collaborative action across governments, businesses and wider society. To ensure both impact and financial rigour, the LIFE strategy employs a dual governance structure. All potential investments must be approved by both the LIFE Committee and the Global Investment Committee. The LIFE Committee assesses whether the company’s core products or services have a clear and measurable link to one or more UN SDGs, while the Global Investment Committee evaluates the financial strength and viability of the investment.

A recent example of this approach is Partners’ investment in Green Flexibility, a German company specialising in battery energy storage. These systems help stabilise energy grids by balancing the intermittent supply from renewable sources such as wind and solar. This investment aligns closely with UN SDG Nine: Industry, Innovation and Infrastructure, which emphasises the development of resilient infrastructure. Green Flexibility’s technology plays a vital role in enabling energy systems to integrate more renewable power, supporting the global transition to a low-carbon economy.

Finding financial services firms that can tell a compelling story of both returns and impact isn’t easy. And convincing people of that story can be even harder, especially given the industry’s reputation for prioritising profit over purpose – not to mention the lingering shadow of the 2008 financial crisis.

For us, that’s why Partners Group stands out. Through its disciplined investment process, strong governance and commitment to frameworks like the UN SDGs and double materiality, it shows that financial institutions can lead with purpose – without compromising on performance. As sustainable investing continues to evolve, Partners Group offers a powerful blueprint for how finance can be a force for good. And that’s a story worth telling.