Challenging the Anthropocene era in the Amazon?

Bond fund manager Stuart Chilvers explains why his team are excited by a new bond that aims to tackle humans’ harmful impact on the Amazon rainforest by supporting its reforestation.

When we try to explain the framework that informs our approach to investing ethically and sustainably in bonds, we often cite Anthropocene theory. That’s the idea that we’re living in a time in which humans have become the most influential force on the planet, causing significant changes to the land, environment, water, organisms and the atmosphere. (You can find out more about Anthropocene theory here.)

That means we’re always on the lookout for bonds to include in our Ethical Bond and Global Sustainable Bond funds that we believe offer us the opportunity to fund projects that aim to reduce humans’ destructive impact on our planet, while also earning attractive financial returns.

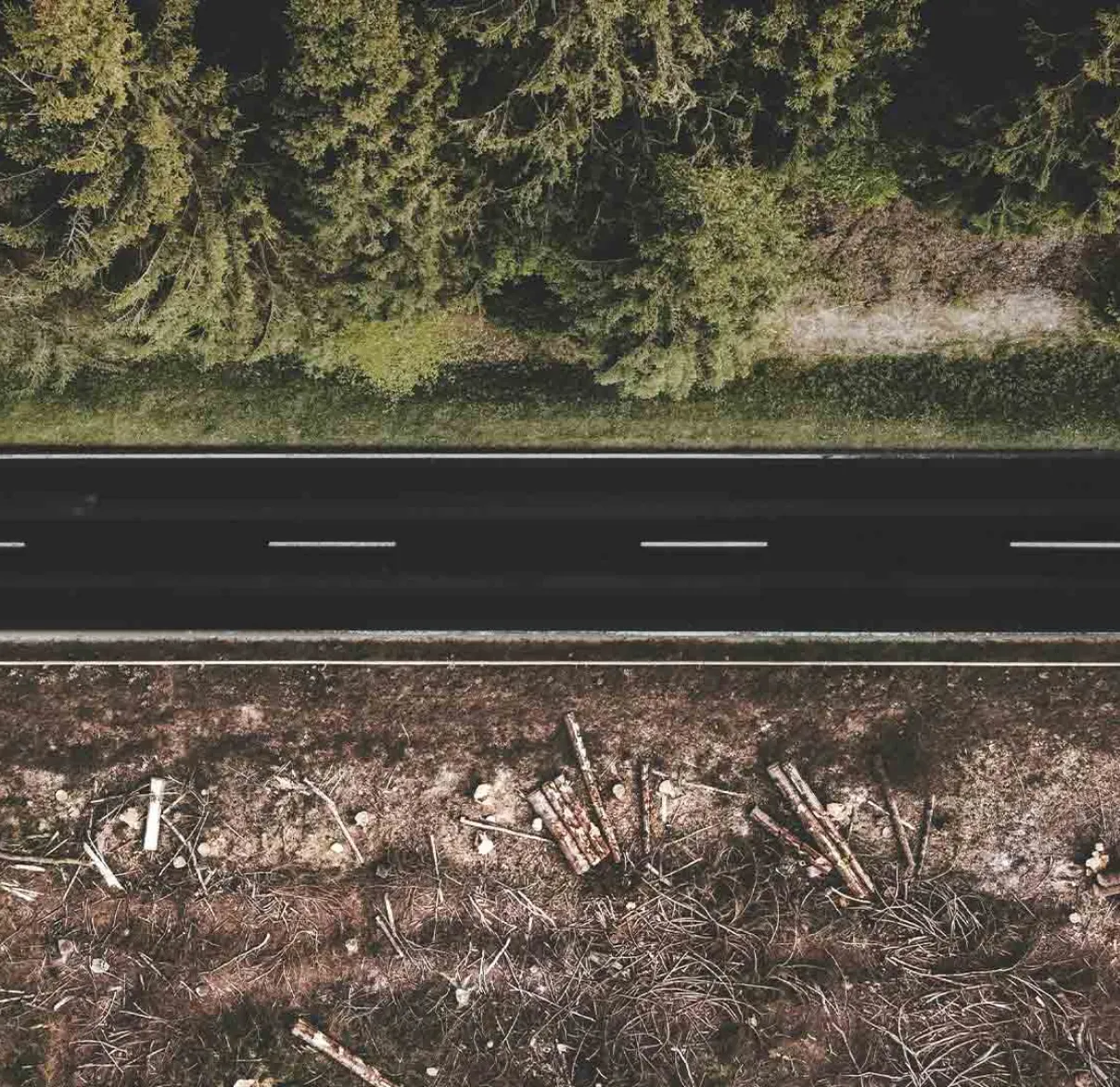

So we were excited to learn that the International Bank for Reconstruction and Development (the IBRD, the lending arm of the World Bank) would be launching an innovative new Amazon reforestation-linked deal over the summer. There’s perhaps nowhere else on earth that provides a more stark example of how human activity can irreversibly change our natural environment than the Amazon rainforest. It plays a critical role as a ‘carbon sink’ for the entire planet, but logging, farming, mining and road and dam building are steadily eating away at the rainforest. It’s estimated that around 17% of Amazon forests have been wholly lost, while a further 17% are now degraded.

Innovative, outcome-driven structure

The IBRD Amazon reforestation bond is an ‘outcome’ bond. That means it’s part of a new trend of bond issuance structured to tie investors’ prospective financial returns explicitly to the outcome of a specific sustainability project.

For this particular bond, the IBRD pays a fixed coupon that’s lower than it would be for a ‘standard’ IBRD bond of similar maturity. The coupon ‘saving’ is transferred to Brazil-based reforestation company Mombak, which uses this circa $36m to fund partnerships with landowners in the Amazon rainforest to reforest degraded land with native tree species. The main bond proceeds ($225m) are used to support the World Bank’s sustainable development activities globally and are repaid by the World Bank when the bond matures in 2033.)

If successful, the Mombak-led reforestation initiatives will generate Carbon Removal Units (CRUs – verified carbon credits; each unit represents the removal of one tonne of carbon dioxide equivalent), while also supporting biodiversity and fostering the socioeconomic development of local communities.

Mombak will work out how much carbon dioxide has been sequestered by reforesting degraded land and its findings will be verified by accredited third parties as specified by an independent carbon credit registry. In the latter years of the bond’s life, investors will receive a variable coupon that’s linked to the value of the CRUs generated. Exactly how much investors will receive depends on the success of the Mombak-led projects, but investors should be protected from any volatility in carbon credit prices. That’s because the CRU-inked interest they’ll earn is driven entirely by the number of CRUs issued (i.e. by the number of tonnes of carbon sequestered) and monetised through a carbon removal purchase agreement that Mombak has secured with Microsoft. Although, obviously, if that deal were terminated, investors would be exposed to carbon credit price volatility.

We felt the IBRD Amazon Reforestation-linked bonds were a fantastic fit for our Ethical and Global Sustainable Bond funds and were thrilled to be one of the lead investors when the deal launched in mid-August. We believe these bonds allow us to invest directly into a project that will have a measurable environmental impact in the Brazilian Amazon while benefiting from the reassurance provided from knowing that the issuer is following international best practice in managing project-related environmental and social risks.

We recognise we could risk receiving a lower return than we would get from investing in a ‘standard’ IBRD bond of equivalent maturity. But if the projects deliver as expected, we should receive a higher return. It’s projected we could earn a total yield of 4.362% from our Amazon Reforestation-linked bonds and that’s above the yield on offer from ‘standard’ IBRD bonds.

Finally, we know that our principal and some of our coupon payments benefit from the extra certainty we gain from lending to an issuer with the highest possible (AAA) credit rating. We’ll certainly be keeping our eyes peeled for similarly exciting opportunities! We’re optimistic. We hope to see the World Bank and other big multilateral lenders favouring similar outcome-oriented structures for their sustainable issuance in future.