A business created to make computer game graphics more beautiful stumbled into driving AI, one of the most important technologies of the 21st century. Rathbone Greenbank Global Sustainability Fund manager David Harrison explains what all the fuss is about.

Artificial returns?

<p>Virtually everyone you talk to is bearish. The future is uncertain. Inflation isn’t falling as fast as everyone would like. Costs from labour to debt interest payments are rising. Central bankers are like a riddle of sphinxes.</p>

<p>And yet, stocks are comfortably up year to date, particularly the digital titans of America: Microsoft, Alphabet, Apple and Amazon, all of which we own, and Meta and Telsa, which we don’t.</p>

Virtually everyone you talk to is bearish. The future is uncertain. Inflation isn’t falling as fast as everyone would like. Costs from labour to debt interest payments are rising. Central bankers are like a riddle of sphinxes.

And yet, stocks are comfortably up year to date, particularly the digital titans of America: Microsoft, Alphabet, Apple and Amazon, all of which we own, and Meta and Telsa, which we don’t.

Markets don’t rise by themselves. They rise because investors bid them higher. They rise because – after all the caveats, consternation and short-term doubts – more people think stocks offer good value than not. It’s the old principle of revealed preferences: the best way to judge what people really think is to see what they buy, not listen to what they say.

It would be easy to explain the outperformance of tech stocks as simply a bounce-back of the interest-rate sensitive ‘growth’ stocks that were laid low in 2022 by rapidly rising interest rates. However, not all of the growth darlings have shot the lights out, and the largest movers seem to be in the digital space. I think part of the uplift in tech stocks may be explained by the promise of profits from the spread of Artificial Intelligence (AI).

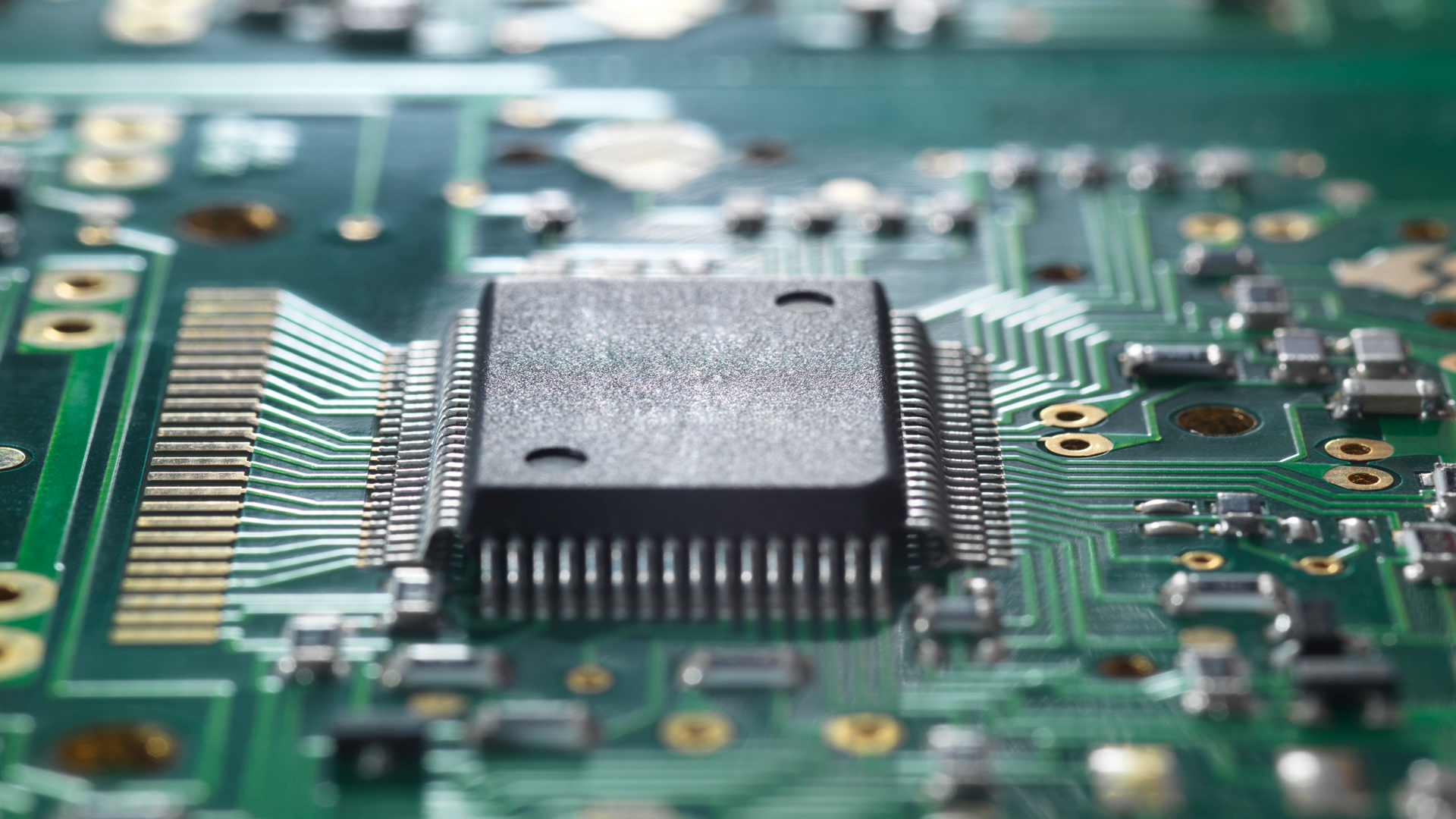

One of the largest gainers so far this year is Nvidia, whose price has doubled year to date. This is a volatile stock – it’s still about 10% below its 2021 peak. It has definitely been a wild ride for us, as long-time holders. Nvidia designs graphics processing units (GPUs), which were created for computers to run 3D graphics. For the last couple of decades, rapid progress was driven by the demand for increasingly realistic graphics in computer games. However, in recent years high-powered GPUs have become integral to blossoming AI. Nvidia is known for making the best GPUs in the business (see the chart below), which may explain why its share price has soared along with the profile of AI programs such as ChapGPT and Alphabet’s Bard. ‘Accelerator’ GPUs are crucial for speeding up computing power to handle AI.

Accelerator-based GPU market share by company

Source: Liftr Insight, Jefferies. More current and detailed data available by Liftr Insights; Nvidia (NVDA), Xilinx (XLNX), Amazon Web Services (AWS), Google Cloud (GCP).

It’s not all without risk, though. This is new ground and there’s always a chance that a market leader will be overtaken by a rival. Also, there’s actually excess inventory in GPUs after production increased a year or so ago to clear a chronic shortage for gaming consoles and computers during the pandemic.

Our exposure to this AI is via the largest tech companies, and ‘picks and shovels’ – the tools of the goldrush – rather than through riskier start-ups seeking to strike gold. It’s hard to quantify the size of the future revenue contribution of AI (perversely that’s usually when you harvest the best returns), but the likely pause in interest rate hikes has probably triggered a return of ‘growth’ stock outperformance, led by these sorts of businesses with AI opportunities.