Filters

Investment Update: Russia/Ukraine: Time to Worry?

Last Updated: July 22, 2025

Most geopolitical crises of recent years have hit local markets hard, but at worst done only fleeting damage to global indices. However, there are three events that buck this trend: the 1973 Yom Kippur War/OPEC oil embargo; the 1979 Iranian Revolution; and the 1990 Iraqi invasion of Kuwait. All centre on the price of energy. A similar oil and gas shock in Eastern Europe as a result of fighting in Ukraine would exacerbate the already sizeable risk that high inflation becomes endemic, which would then require tighter monetary policy to get it under control.

Rathbones targets modern slavery for third year with biggest collaborative engagement yet

Last Updated: July 22, 2025

Rathbones has launched its third Votes Against Slavery engagement, securing support from 122 investors with assets under management totalling £9.6 trillion.

Quarterly Investment Update video: Staying defensive as risks continue to build

Last Updated: July 22, 2025

Rathbones’ co-chief investment officer Ed Smith explains why we can see a path to better returns, but there are substantial dangers to be guarded against.

Big gains for big stocks obscure some hidden gems

Last Updated: July 22, 2025

We’ve been exploring the investment opportunities among oft-overlooked small and mid-sized companies.

Talking to the next generation about money webinar

Last Updated: July 22, 2025

Join us for an insightful webinar to discuss how a family board meeting can be used to talk to the next generation about money.

Are you aware of the 60% income tax trap?

Last Updated: July 24, 2025

Brits are paying ever more in taxes, but that doesn’t mean you have to. With a bit of care and maybe some advice, you could avoid paying thousands of pounds more than you would otherwise.

Rathbones combatting modern slavery webinar

Last Updated: July 22, 2025

Modern slavery and human trafficking is a pervasive risk to society and to our clients' investments. It is imperative that all companies play their part in seeking to reduce the opportunities for modern slavery to occur.

Review of the week: The bank of mum and dad

Last Updated: July 22, 2025

UK central bankers fall into an age-old parenting trap while talking to investors. Also, we look at the differences between official statistics and new ‘real-time’ series.

Is it time to consider a total return strategy?

Last Updated: July 22, 2025

Fiona Gillespie, Head of Charities - Scotland, explores the options available to charity trustees in terms of investment strategy.

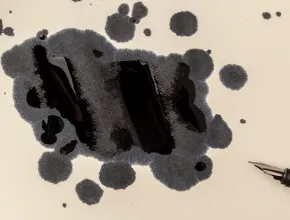

Quarterly Investment Update: A Rorschach test for investors

Last Updated: July 22, 2025

What to do when markets and data seem full of conflicting messages

Opportunities and challenges for the charity sector in the 2024 Autumn Budget

Last Updated: September 15, 2025

The Autumn Budget 2024 presents a mixed picture for the UK charity sector, with both opportunities and challenges. Read our key highlights.

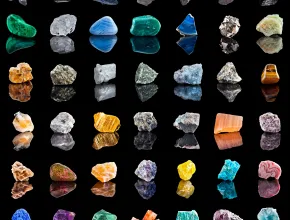

Is the Chinese dragon losing its appetite for industrial metals?

Last Updated: July 22, 2025

For many years the fortunes of the FTSE mining sector have been linked to developments in China. Rapid growth in demand for commodities like iron ore and copper in the late 2000s led to what became known as the first mining supercycle. That was followed by a downturn from 2011—15 as slowing demand from China combined with overexpansion of mining production.