Filters

Delay, delay: Groundhog Day

Last Updated: September 30, 2025

The fog of uncertainty won’t disperse anytime soon. But the FTSE is an international market, defensive and quite possibly one of the better places to be as global growth slows.

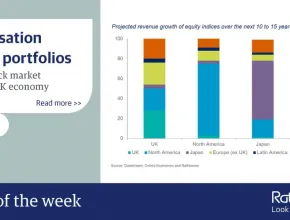

Chart of the week: Globalisation buffers portfolios

Last Updated: September 30, 2025

A quick look at the geographic exposure of the UK stock market reveals that the vast majority of UK stock market earnings are sourced from overseas. This is great news, as it means that our stock market is exposed to faster-growing economies which should boost revenue growth for UK equities. The benefits of globalisation should buffer any heavily UK-exposed portfolios. Read more about the future of our economy in our latest Investment Insights.

Mixed signals

Last Updated: September 30, 2025

Equity markets are in a happy mood, climbing through a fog of uncertainty with omens of recession tolling from the bond market. Julian Chillingworth, Rathbones chief investment officer, explains why we think it still makes sense to stay invested, but with vigilance.

Eurosif transparency accreditation

Last Updated: September 30, 2025

We are delighted to announce that the Rathbone Ethical Bond Fund has once again been awarded the rights to display the European SRI Transparency logo.

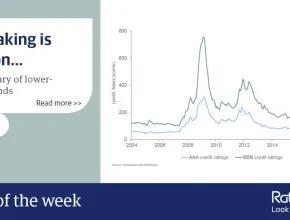

Chart of the week: Risk-taking is back on...

Last Updated: September 30, 2025

…but be wary of lower-quality bonds

Rathbones multi-asset funds: the blessed trinity

Last Updated: September 30, 2025

With the Fed putting the brakes on rate hikes, Chinese growth rebounding and positive noises coming out of US-China trade discussions, assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios following the strong bounce back in equity markets so far this year.

Rathbones Multi-Asset update - The Blessed Trinity

Last Updated: September 30, 2025

With the Fed putting the brakes on rate hikes, Chinese growth rebounding and positive noises coming out of US-China trade discussions, assistant fund manager Will McIntosh-Whyte discusses how the RMAPs team is positioning portfolios following the strong bounce back in equity markets so far this year.

It’s important to be patient as the business cycle matures

Last Updated: September 30, 2025

Owing to its size and influence around the world, what happens in the US economy has important implications for financial markets everywhere.

Chart of the week: An indigestible amount of debt?

Last Updated: September 30, 2025

Quality hasn’t just deteriorated in the sterling-denominated corporate bond market, but the lowest-rated BBB segment has also grown substantially as a proportion of the euro and US dollar investment-grade markets, which are both far bigger. If the rate of downgrades in the next recession is similar to the rate in the previous one, the next rung down in the bond markets – high yield debt markets – could get swamped.

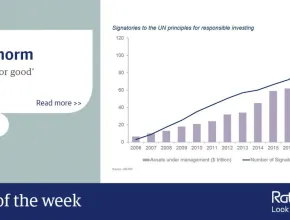

Chart of the week: A new norm

Last Updated: September 30, 2025

As society struggled to get back on its feet in the wake of the 2008 global financial crisis, one thing was clear: society needs the investment industry to be active and responsible. For many, this meant thinking about signing the Stewardship Code, and upping their game on proxy voting and engagement with underlying companies. For us, this created further incentive to refine our existing approach. Since then, responsible investing has become mainstream and over 2,000 asset managers around the world are now signatories to the UN-backed Principles for Responsible Investing (PRI).

Rathbone Global Sustainability Fund

Last Updated: September 30, 2025

David Harrison, fund manager of the Rathbone Global Sustainability Fund discusses current investment themes and how he has shaped the current portfolio to maximise returns while remaining in line with the UN Sustainable Development Goals.

Chart of the week: Value seekers eye sterling

Last Updated: September 30, 2025

Kicking the Brexit can all the way to Halloween has done nothing but prolong the uncertainty that’s shrouded us for so long. The ‘good news’ is that we think sterling now looks so undervalued that, no matter what happens with Brexit, it should appreciate over the long term. So, those willing to hold on for a rough ride just may find themselves reaping the rewards when the Brexit puzzle is finally solved.