Filters

Rathbones’ Smith: “ECB bazooka futile in the long run”

Last Updated: September 30, 2025

Rathbones’ Smith: “ECB bazooka futile in the long run”

Fixed income webcast update - Strategic Bond

Last Updated: September 30, 2025

Navigating the bond market to protect investor capital and ensure consistency of returns through periods of extended volatility.

Fixed income - Ethical Bond

Last Updated: September 30, 2025

Inflation through to Brexit are the current themes occupying the fixed income space. Hear where we currently sit within the economic cycle. Taking a look at some notable funds and credits

Rathbone Multi-Asset Portfolios

Last Updated: September 30, 2025

The car crash that is Brexit and the accident waiting to happen – Europe. More positively David will cover areas where he feels more confident such as health, e-commerce and entertainment.

Rathbone Income fund

Last Updated: September 30, 2025

Performance review of the fund during 2018. Discussing the strategy and positioning; looking ahead and considering where opportunities for long term performance may be found in the current landscape.

Rathbone Global Opportunities Fund

Last Updated: September 30, 2025

Policy tightening is meeting slower economic growth, a trade war and widespread displeasure with ineffective political solutions. The good news is that investors, sensitive to the complacency that defined the pre-Lehman years, may have overly discounted the slowdown....assuming it will be as toxic as the 2008 crisis.

Macro-economic

Last Updated: September 30, 2025

What is the outlook for markets in 2019, is there a chance that the US will enter recession and how quickly will the Chinese economy slow?

Rathbone UK Opportunities Fund

Last Updated: September 30, 2025

Markets, even the UK, have climbed the wall of worry and rallied hard so far in 2019. With the Rathbone UK Opportunities Fund up over 14% year to date (to 23.04.19), we ask manager Alexandra Jackson where to from here.

A last gasp

Last Updated: September 30, 2025

At his penultimate meeting, outgoing President of the European Central Bank (ECB) Mario Draghi announced a series of measures to ease monetary policy in the listless region. The bank cut deposit rates by 10 basis points to -0.50% and will restart quantitative easing (QE) on 1 November. At just €20 billion (£17.7bn) per month it’s peanuts compared to historic QE – since 2015 the ECB’s bond purchases have totalled €2.65 trillion – but crucially the new programme has no set end date. Until inflation gets back to 2% and stays there, QE and zero rates are here to stay.

Rathbones Asset Management Webinars

Last Updated: September 30, 2025

Register for the latest Rathbones Asset Management webinars, where the Fund Managers provide their latest views on markets and discuss fund performance. You can also browse our back catalogue for past webinars on demand. Sign up and watch below.

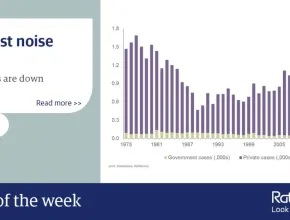

Chart of the week: Antitrust noise is up…

Last Updated: September 30, 2025

Just like other life-transforming technologies of the past, today’s tech giants are reaching maturity — that inevitable transformation from fresh young face of innovation to overgrown, mistrusted hulk. Their share prices fell amid reports that US antitrust bodies would be taking a closer look at their competitive practices for possible violations. We don’t think a bust-up is imminent but further volatility is likely for the big US tech firms in the near term.

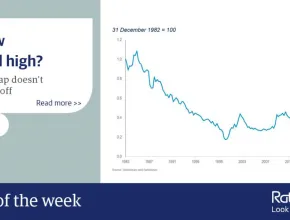

Chart of the week: Buy low and sell high?

Last Updated: September 30, 2025

Put crudely, the job of an active investor is to buy low and sell high. Identifying companies and markets that are ‘cheap’ (attractive) and ‘expensive’ (to be avoided) is commonly done using PE ratios, the price divided by the underlying annual earnings for that company or market. But in all but a few specific situations, when it comes to choosing one investment over another, it’s often more hindrance than help, especially over shorter time periods.